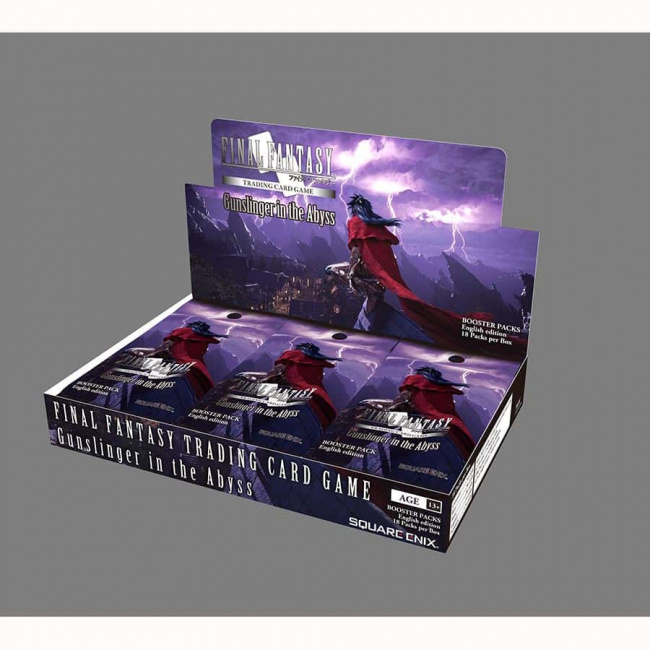

There has been a lot of chatter on social media and content creator channels about the concept of TCG shrinkflation. Essentially, TCG shrinkflation can be best described as the reconfiguration of product SKUs by companies to offer the consumer less product while keeping prices per unit the same or raising them. It is a common method utilized by companies to control prices across several industries, and is used to offset the effects of inflation. Recently, it was brought into spotlight on social media by TCG fans after product reconfigurations Wizards of the Coast with Magic: The Gathering and with Square Enix’s Final Fantasy TCG pack reduction per box (see “‘Final Fantasy TCG’ Packs“).

But how bad is TCG shrinkflation, actually?

I took a look at the TCG products on the market and their historical price numbers, and found a few interesting takeaways. Before we get into the “meat” of this subject, it should be stated that TCG shrinkflation is largely a problem on the consumer side as retailers will generally order product to meet demand regardless of the box configuration. However, there is an indirect impact of shrinkflation on retailers in the form of negative consumer sentiment that develops as TCG fans realize that they dollar doesn’t go as far per display box.

The first takeaway from my examination of TCG shrinkflation is actually a fairly positive one. It seems that the larger Japanese TCG companies are fairly resilient to both inflation and shrinkflation. Both Pokemon TCG and Yu-Gi-Oh! TCG have marginally raised their prices in the last five years, from $3.99 to $4.49 (about 12.5%). This price raise is actually less than the 2.9% average CPI increases over the last five years, which is good news for fans and retailers alike. Shrinkflation can only really be seen in these game lines in minor ways, such as the Pokemon’s reduction of the size of their Jumbo cards and the perceived shrinkflation of the company going to a booster bundle display format.

For American companies, WotC had recently reinstated MSRP for their Magic: The Gathering products, which revealed some evidence of shrinkflation (see “MSRPs for ‘Magic: The Gathering“). In 2018, a pack of Ravnica Allegiance had an MSRP of $3.99 and there were 36 packs per displayunit. A little over six years later, in 2025, Aetherdrift packs cost $5.49 and come with 30 packs per display unit. The shrinkflation is fairly evident here, as there are now less packs per box and the price is higher.

WotC’s shrinkflation will likely cause more issues with singles card shops than with shops that just sell sealed product. Stores that do mass booster box openings for singles may find it harder to get their EV out of their boxes as there are both less boosters per box and the boxes cost. Allocations could also be more of a problem than usual, as display boxes don’t go as far on the countertop (having only 30 packs) and if a retailer gets allocated, they might be short product on their order because there are less boosters per case.

As one more takeaway, inflation seems to be hitting smaller companies a little harder than their larger counterparts in general. Out of the TCG booster box data I surveyed from ICv2’s past reporting, most mid-size to smaller TCG companies did not reconfigure their products per display unit very much, but were up in price per pack anywhere from $0.50 to $1.00 since 2019. Square Enix’s recent Final Fantasy TCG product seemed to be an anomaly here as they opted to reconfigure their booster boxes drastically rather than implement larger price increases per box. TCG companies with new games entering the market post-COVID, for the most part, had already priced in inflation as they entered into the space during an upswing in the TCG market overall.

In short, the effect of TCG shrinkflation is fairly overblown for the vast majority of products. The only company that truly ventured outside the box with raising prices and reducing product per unit was WotC and Magic: The Gathering, and I’m fairly sure this was less of a production cost issue and more of a profit increase move. And why not? Magic was on fire for the last couple of years with over a billion dollars in sales each year and the demand is clearly there. With a Spider-man Magic set on its way in 2025 (see ” ‘Magic: The Gathering’ in 2025“), demand is only likely to go higher and WotC can continue make the money while it still on the table.

Read more at this site